Private Equity Market Size to Worth USD 20,242.70 billion by 2034 | CAGR of 13.2% during 2026-2034

Global private equity market poised to grow from USD 6,749.85 billion in 2025 to USD 20,242.70 billion by 2034 at a CAGR of 13.2%

NEW YORK, NY, UNITED STATES, February 6, 2026 /EINPresswire.com/ -- The global private equity market size was valued at USD 6,749.85 billion in 2025. The market is projected to grow from USD 7,499.57 billion in 2026 to USD 20,242.70 billion by 2034, exhibiting a CAGR of 13.2% during the forecast period. The private equity market is a major component of the global alternative investments landscape, focused on investing in privately held companies or taking public companies private. Private equity firms deploy capital across strategies such as buyouts, growth equity, and turnaround investments to drive operational improvements and long-term value creation. The market has expanded significantly over the years due to strong institutional investor participation and the pursuit of higher risk-adjusted returns.Get a Free Sample of this Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/private-equity-market-115246

Key Market Insights

Institutional investors continue to be the largest contributors to private equity fundraising, providing significant capital through pension funds, insurance companies, endowments, and sovereign wealth funds. Buyout funds account for the largest share of total private equity assets, as they focus on acquiring controlling stakes and driving operational improvements in portfolio companies. The private equity asset class is characterized by long investment horizons, typically spanning several years, combined with active portfolio management aimed at value creation and performance enhancement. Through strategic oversight, operational restructuring, and financial optimization, private equity firms play a critical role in corporate restructuring and business expansion, supporting growth, competitiveness, and long-term profitability across a wide range of industries.

Market Trends

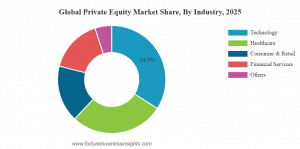

Private equity firms are increasingly focusing on value creation through operational improvements and digital transformation initiatives across portfolio companies. This includes optimizing processes, adopting advanced technologies, and strengthening management capabilities to drive long-term performance. Investment activity is rising notably in high-growth sectors such as technology, healthcare, and renewable energy, reflecting strong demand fundamentals and innovation potential. At the same time, there is a growing emphasis on integrating environmental, social, and governance (ESG) principles into investment strategies, as investors prioritize responsible and sustainable value creation. Additionally, private equity activity is expanding steadily in emerging markets, where improving economic conditions, market liberalization, and attractive valuations are creating new opportunities for growth-oriented investments.

Market Growth Factors

Investors are increasingly turning to private equity in search of higher returns compared to traditional asset classes such as public equities and fixed income. Pension funds and sovereign wealth funds are steadily increasing their allocations to alternative investments as part of long-term portfolio diversification strategies. The availability of large amounts of dry powder is further supporting deal activity, enabling private equity firms to pursue new investments across various sectors and geographies. In addition, favorable long-term economic growth prospects and the rise of innovation-driven business models are creating attractive opportunities for value creation. These factors collectively are strengthening investor confidence and sustaining strong momentum in private equity investment activity.

Segmentation Analysis

By Investment Type:

• Buyouts

• Growth Equity

• Venture Capital

• Distressed / Special Situations

By Fund Type:

• Large-Cap Funds

• Mid-Market Funds

• Small-Cap Funds

By End User / Investor:

• Pension Funds

• Sovereign Wealth Funds

• Insurance Companies

• Family Offices

• High-Net-Worth Individuals

Speak to Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/private-equity-market-115246

Regional Analysis

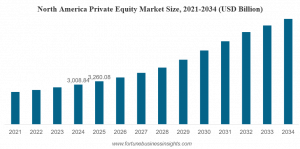

North America dominates the private equity market, supported by a mature investment ecosystem, a large institutional investor base, and consistently strong deal activity across multiple sectors. Europe holds a significant market presence, driven by active cross-border investments, well-developed financial markets, and increasing sector diversification spanning technology, healthcare, and industrials. The Asia Pacific region is emerging as the fastest-growing market, fueled by rapid economic expansion, rising startup activity, and increasing private capital inflows across China, India, and Southeast Asia. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual growth, supported by infrastructure development initiatives, improving regulatory environments, and the emergence of new private enterprise opportunities across key industries.

Key Industry Players

• Blackstone (U.S.)

• KKR & Co. (U.S.)

• Apollo Global Management (U.S.)

• The Carlyle Group (U.S.)

• TPG (U.S.)

• Bain Capital (U.S.)

• Warburg Pincus (U.S.)

• Thoma Bravo (U.S.)

• Vista Equity Partner (U.S.)

• EQT (Sweden)

• CVC Capital Partners (Luxembourg)

• Advent International (U.S.)

• Permira (U.K.)

• Ardian (France)

• Hellman & Friedman (U.S.)

Key Industry Developments

• November 2025: Tata Consultancy Services (TCS) announced a strategic partnership with TPG, a global alternative asset management firm, to support the growth of its AI data center business, HyperVault. TCS’s HyperVault will be funded through a mix of equity from TCS and TPG, and debt.

• September 2025: Goldman Sachs and T. Rowe Price announced a strategic collaboration aimed at delivering a range of diversified public and private market solutions designed for the unique needs of retirement and wealth investors.

Future Outlook

The private equity market is expected to maintain steady growth, supported by sustained investor interest and a continued shift toward alternative investments for long-term value creation. Innovation-led deal flow across sectors such as technology, healthcare, and renewable energy is creating attractive opportunities for private equity firms to deploy capital effectively. Expanding investment prospects in emerging economies are further strengthening market momentum, as improving economic conditions and entrepreneurial activity attract private capital. Although macroeconomic uncertainty, interest rate fluctuations, and regulatory scrutiny may influence deal structures and investment timelines, they are also encouraging more disciplined due diligence and strategic portfolio management. Overall, private equity is likely to remain a preferred asset class, offering long-term capital appreciation, operational value creation, and active ownership strategies that support sustainable business growth.

Read Related Insights:

Internet of Things (IoT) in BFSI Market

Generative AI in BFSI Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.